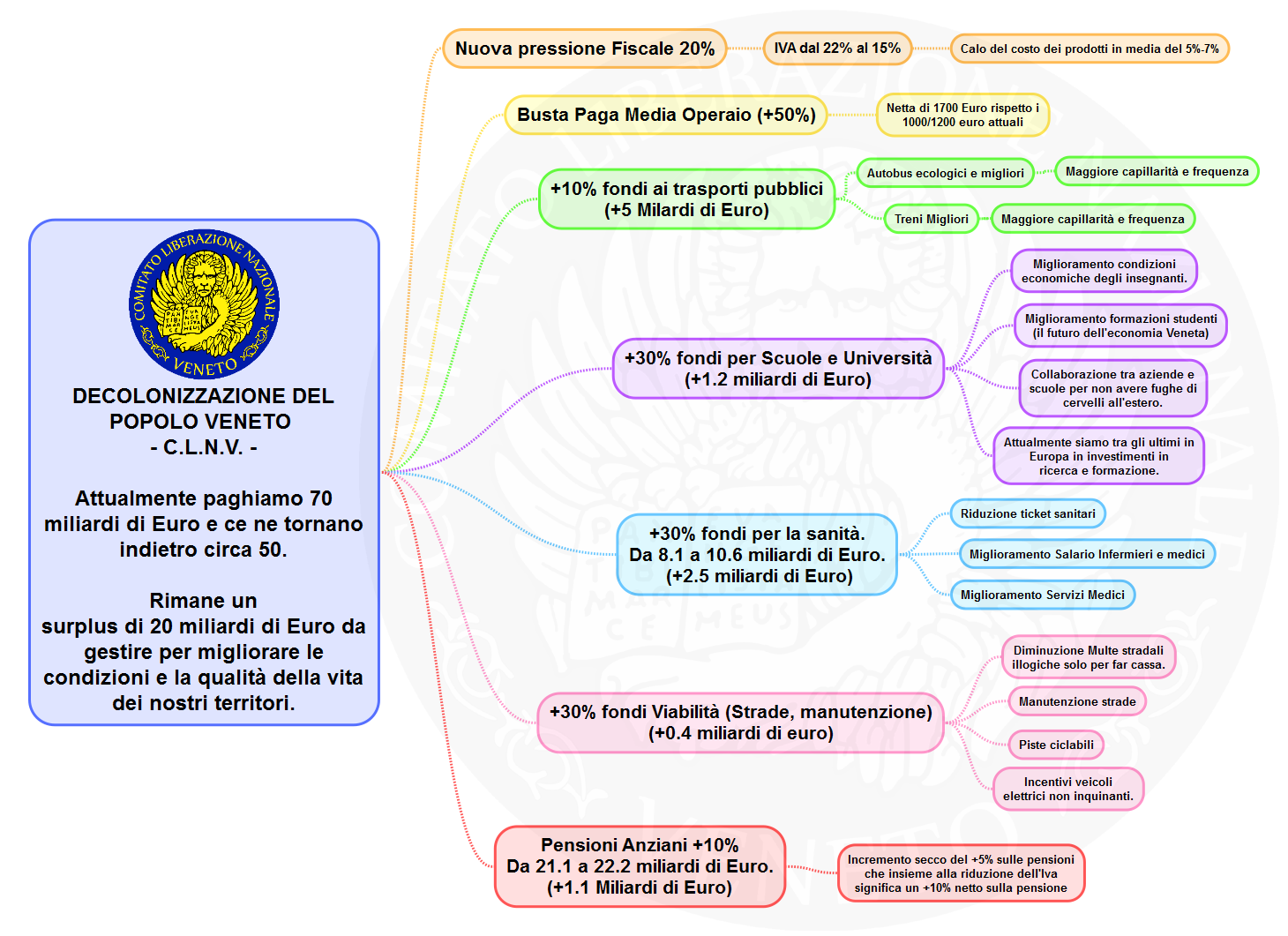

With 20 billion more available, Irpef can reach 20% and VAT at 15%.

In addition, money would remain for public works and to raise pensions.

Below is an excellent article on the most likely economic scenario after a ‘ Decolonization of the Veneto People ‘.

The economic study takes as a reference only the territories of the current Veneto Region but the numbers should be integrated with the addition of the Provinces of Brescia and Bergamo.

Furthermore, the Author envisages a controlled tax reduction dynamic to avoid inflationary events that could lead to uncontrolled price increases.

It is important to understand in practice also with numbers the economic and ethical advantages that the path of the CLNV would bring to the Veneto People and to our families.

We must realize how much it costs us to stay in Italy, to understand why there is more well-being around Europe.

We are so used to being told that the resources are insufficient that it seems impossible to have to pose such a problem.

But if Veneto were decolonized by Italy, what would it change?

Let’s try to do a simple arithmetic account.

On paper, the current fiscal pressure in Veneto is 70 billion euros ** compared to an alleged total of 50 billion in public services that should come back to us.

We also admit that in the early years the Venetian public administration is as inefficient as the Roman one (and that there are no immediate savings due to a state reorganization).

At a minimum we would have 20 billion surplus to manage, either with less taxes, or with more public services.

Twenty billion is twice the current financial resources of the Veneto Region, and it is likely that the Veneto State surplus is also much more.

To begin with we will be embarrassed that we will not be able to lower taxes too quickly to avoid creating inflationary pressure in our economy. We will also have too many resources to invest in our health system, in our schools, and we will also be able to finally allow ourselves to give a decent pension to our elderly.

By lowering tax revenues (less taxes) and raising spending (Italy would leave us in “canvas breeches”, and we will have to pay doctors and teachers) we get a balance sheet of public accounts.

Tax reduction – The tax burden will drop by around 20% (from the 70 billion euros of taxes that the central state takes now, to immediately 55 billion in the first years of decolonization).

A) Indirect taxes will be reduced by 25%.

This means that VAT will be lowered from the current 22% to 15%. As a first impact it is better not to lower more to wait for the market to adapt (and that further cuts are not offset by higher margins of retailers).

Afterwards it will be up to each Province to decide whether to lower or increase its VAT according to a true federal system.But in the meantime, with a Decolonization of the Veneto People all the products will immediately cost 5-7% less.

B) Social contributions will no longer be taken directly from the employer , but will be included in the pay packet (as in Denmark). This means that a net worker who receives 1200 euros a month, and that gross of Irpef and what are called “contributions paid by the worker” if he saw 1900 euros a month, with a State of the People Veneto decolonized will receive in pay slip the real gross (what he actually applies to the employer) of 2,500 euros, which also includes 26.5% of additional contributions that the worker does not see, but that the state receives each month in his name. The social contributions will be reduced by 25% and instead of paying 600 euros the payment for our worker will drop to 450.

In the coming years these contributions will be paid to the Veneto State, but as soon as it is better organized, each worker can also entrust the payments for his pension to a private pension insurance.

C) As direct taxes there will instantly be a single and fixed tax of 20% (later it is likely that we will be forced to lower it again due to the inevitable virtuous cycle due to this economic stimulus that will give us additional surplus). Bringing income taxes to 20% does not mean the collapse of tax revenues. Due to the poor distribution of income in Italy, many are already paying a little more. Our previous worker will probably pay 27% tax from his salary now. The total impact will be -15% on the state coffers.

In conclusion, our worker will find 2500 euros in payroll and, net, taking away 450 euros of social contributions and 400 of taxes (at 20%), he will get a net envelope of 1700 euros . Compared to the 1000-1200 now, it is a nice 50% more to go shopping and also pay 5-7% less (due to lowered VAT) on everything.

More public services – Even with all this tax reduction, Veneto still has an abundant 5 billion surplus that it could use for an average growth in public services of 10%.

It is true that there are so many wastes, but it is also true that Italy has reduced us to shameful public services.

A. We could very well afford to immediately increase public spending on health by 30% (from 8.1 to 10.6 billion).

To make sure that they do not end up in the usual procurement of dubious necessity, this increase must be addressed mostly on staff: more doctors and nurses, and paid much better. We do not realize but compared to other industrialized states our doctors and nurses are paid much less.

B. We have a duty to invest heavily in education.

Minimum 30% more for schools and universities (from 3.9 to 5.1 billion). Coming out of a retrograde system, immediately investing 1.2 billion more on our schools is mandatory. Not only for the salary of our teachers and professors of middle and high schools, but also to encourage research in our universities, which must serve as a support for our industries. At the moment we are very backward in investments in research and development, but really a lot: last in Europe.

C. 30% more funds for traffic.

400 million more for roads, trains and airports are not too many. It is essential that this money is not managed centrally, but is administered directly by the municipalities. This is to avoid procurement of pharaonic works, when instead we need maintenance (to lend a white coat to the pedestrian crossing, to close the holes on the asphalt …) all over the territory.

D. Even with all these billions more spent, we still have enough to comfortably raise the pension of our elderly by 5% (from 21.1 billion to 22.2 billion for pension provision).

Overall a pensioner will have a higher pension of 5% and lower market prices of 5% (VAT reduction effect). A good 10% more wellness to pass a serene old age, and to console yourself for the losses on Italian BOTs that many will unfortunately be obstinate to keep until the last.

Even taking into account the tax cuts and this generous increase in public spending, the Veneto budget remains in surplus of 159 million, roughly 0.1% of Veneto’s GDP.

Source: Lodovico Pizzati *

* Professor of business statistics at California State University, Los Angeles.

** Economic data based on the years 2008/2010